|

Asset |

$ |

Liabilities and

Capital |

$. |

| |

|

|

|

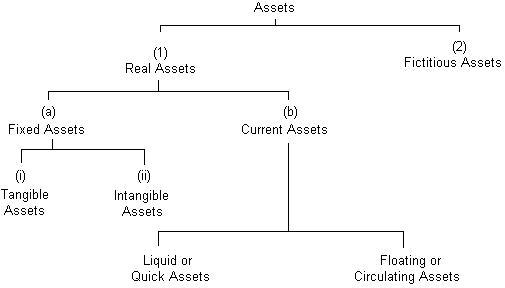

Assets may

be classified as follows:

Real Assets:

Assets

which have some market value are called real assets,

e.g. building, machinery, stock, debtors, cash,

goodwill, etc. Real assets are further divided into two

types according to their permanence:

Fixed Assets:

Assets which have long

life and which are bought for use for a long period of

time are called "fixed assets". These are not bought for

selling purposes, e.g. land, building, plant, machinery,

furniture etc. Fixed assets are again sub-divided into

two:

-

Tangible Assets: Assets which have physical

existence and which can be seen, touched and felt

are called "tangible assets", e.g. building, plant,

machinery, furniture etc.

-

Intangible Assets: Assets which have no

physical existence and which cannot be seen, touched

or felt are called "intangible assets", e.g.

goodwill, patent right, trade mark etc.

Current

Assets: Assets which are short-lived and which can be

converted into cash quickly to meet short term

liabilities are called "current assets", e.g. stock

debtors, cash etc. Such assets change their form

repeatedly and so, they are also known as circulating

or floating assets. For example, on purchase of

goods cash is converted into stock and on sale of goods,

stock is converted into debtors, on collection from

debtors, debtors take the form of cash etc.

Out of

current assets those which can be converted into cash

very quickly or which are already in the form of cash

are called liquid or quick assets e.g. debtors,

cash in hand, cash at bank etc.

Fictitious Assets:

Assets which have no market value are called

fictitious assets. examples of fictitious assets

include preliminary expenses, loss on issue of shares

etc. They are also known as nominal assets.

Besides

these, there is another type of assets whose value

gradually reduce on account of use and finally exhaust

completely. This type of assets is called wasting assets

e.g. mine, forest etc.

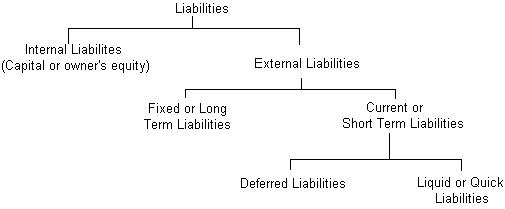

Internal Liabilities:

The total amount of debts payable

by a business to its owner is called internal liability

e.g. Owner's equity (capital), reserve etc. From

practical view point internal liabilities should not be

regarded as liabilities, since there is no question of

meeting such liabilities al long as the business

continues.

External Liabilities:

All debts payable by a

business to the outsiders (other than the owner) are

called external liabilities e.g. creditors, debentures,

bills payable, bank overdraft, etc. External liabilities

are further divided into two.

Fixed or Long Tern

Liabilities: The liabilities which are payable after

a long period of time are called fixed or long term

liabilities e.g. debentures, loan on mortgage etc.

Current or Short Term

Liabilities: The debts which are repayable within a

short period of time are called current or short-term

liabilities e.g. creditors, bills payable, bank

overdraft etc. Current liabilities may again be divided

into two:

-

Deferred Liabilities: Debts which are repayable

in the course of less than one year but more than

one month are called deferred liabilities e.g. Short

term loan etc.

-

Liquid or Quick Liabilities: Debts are repayable

in the course of a month are called liquid or quick

liabilities e.g. bank overdraft, outstanding

expenses, creditors etc.

Besides

the above, there is another type of liability which is

known as contingent liability. It is one

which is not a liability at present, but which may or

may not become a liability in in future. It depends upon

certain future event. For example, suppose, the buyer of

goods filed a suit in the court against the seller

claiming damage of $10,000 for breach of contract. This

will be regarded as a contingent liability to the seller

until the receipt of the court's order. To the buyer,

this is a contingent asset. Both contingent liability

and contingent asset are not recorded in the balance

sheet. They are generally mentioned in the balance sheet

as a note.

As we have

discussed that the main purpose of balance sheet is to

disclose a true and fair financial position of a

business on a particular date. So, the assets and

liabilities must be shown in such a manner that the

financial position of the business can be assessed

through it easily and quickly. Thus an arrangement is

made in which assets and liabilities are shown in the

balance sheet. Such an arrangement is called marshaling

of assets and liabilities. There are three methods of

marshaling:

-

Permanency Preference Method

-

Liquidity Preference Method

-

Mixed

Method

These

methods of preparing a balance sheet are briefly

explained below:

Permanency Preference Method:

Under this

method, the assets and liabilities are shown in balance

sheet in the order of their permanence. In other words,

the more permanent the assets and liabilities, the

earlier are they shown. This method is adopted by joint

stock companies and under this method the balance sheet

will take the following form:

Balance Sheet as

at.....

|

Assets |

$ |

Liabilities |

$ |

|

Fixed Assets:

Good will

Patent

Land

Building

Plant & Machinery

Furniture & Fixtures

Current

Assets:

Investment

Stock

Sundry debtors

Bills receivable

Prepaid expenses

Liquid

Assets:

Cash at bank

Cash in hand |

|

Fixed Liabilities:

Capital

Reserves

Long term loans

Current

Liabilities:

Sundry creditors

Bills payable

Bank overdraft

Outstanding expenses |

|

Liquidity Preference Method:

Under this

method, assets and liabilities are shown in order of

their liquidity. The more liquid the assets, the earlier

are they shown. The sooner the liabilities are to be

paid off, the earlier are they shown. This method is

adopted by sole proprietorship and partner ship

business. Under this method the form of balance sheet

is:

Balance Sheet as

at.....

|

Assets |

$ |

Liabilities |

$ |

|

Liquid Assets:

Cash at bank

Cash in hand

Current

Assets:

Investment

Stock

Sundry debtors

Bills receivable

Prepaid expenses

Fixed

Assets:

Good will

Patent

Land

Building

Plant & Machinery

Furniture & Fixtures |

|

Current

Liabilities:

Sundry creditors

Bills payable

Bank overdraft

Outstanding expenses

Fixed

Liabilities:

Capital

Reserves

Long term loans |

|

(Liquidity preference method is exactly reverse of the

first method)

Mixed Method:

Under this

method, assets are shown in the order of permanence and

liabilities are shown in order of liquidity. This method

is adopted by banks and insurance companies etc.