Break-even Point Analysis:

Contents:

-

Definition and Explanation

-

Calculation by equation

method

-

Calculation by

contribution margin method

-

Advantages

-

Limitations

-

Review problem

Break-even point

is the level of sales at which profit is zero. At break even

point total sales are equal to total cost (variable

+ fixed).

If a firm cannot manage sales

to cover variable as well as fixed costs it will have to bear

losses. The following is the further explanation of

this concept:

|

Profit |

|

Sales > Variable Expenses +

Fixed Expenses |

|

|

|

Break-even Point |

|

Sales = Variable Expenses +

Fixed Expenses |

| |

|

Loss |

|

Sales < Variable Expenses +

Fixed Expenses |

|

There are two

methods for the calculation of break-even point.

These are:

- Equation

method

- Contribution

margin method

We can use the

following equation to calculate break-even point:

Profit = Sales - (Variable expenses + Fixed

expenses)

or

Sales = Variable expenses + Fixed expenses + Profit

When break-even

point is calculated using above equation profit is

taken as zero because break-even is that level of

sales where sales are equal to total cost (variable

+ fixed) and profit is zero.

Example:

We can

use the following data to calculate break-even

point.

-

Sales price per unit = $500

-

variable cost per unit = $300

-

Total fixed expenses = $70,000

Required:

Calculate break-even point using equation method.

Solution:

Sales = Variable expenses + Fixed expenses + Profit

$500Q* = $300Q*

+ $70,000 + $0**

$200Q = $70,000

Q =

$70,000/$200

Q =

350 Units

Q*

= Number (Quantity) of units sold.

**The break even point

can be computed by finding that point where profit

is zero

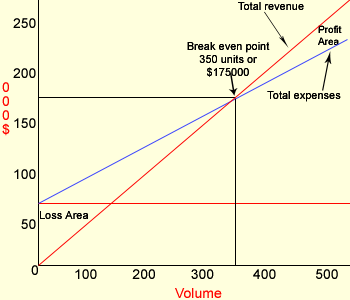

Graphical

Representation (Break-even Chart

- CVP Graph):

The break even

point in sales dollars can be computed by

multiplying the break even level of unit sales by

the selling price per unit.

350

Units × $500 Per unit = $175,000

Under this method

total fixed cost is divided by unit contribution

margin. The resulting figure is number of units to

be sold to break-even (no profit, no loss).

Example:

We can

use the following data to calculate break-even

point.

-

Sales price per unit = $500

-

variable cost per unit = $300

-

Total fixed expenses = $70,000

Required:

Calculate break-even point using contribution margin

method.

Solution:

Break-even point in units = Fixed expenses / Unit

contribution margin

$70,000 / $200*

350

Units

*$500 (Sales) − $300

(Variable exp.)

Break even point in

sales:

350

Units × $500 Per unit

= $175,000

Equation method and

contribution margin methods are equivalent.

Contribution margin method is actually a shortcut

conversion of equation method.

The following

formula is also extensively used to calculate break

even point:

Break-even Sales in Dollars = [Fixed Cost / 1 –

(Variable Cost / Sales)]

This formula

produces the same answer:

Break Even Point = [$70,000 / 1 – (300 / 500)]

=

$70,000 / 1 – 0.6

=

$70,000 / 0.4

=

$175,000

Number of units to be sold to

break even:

$175,000 / $500

= 350 units

Following are some of the main

advantages of break even analysis:

- It explains the

relationship between cost, production, volume and returns.

- It can be extended to show

how changes in fixed cost, variable cost, commodity prices,

revenues will effect profit levels and break even points.

Break even analysis is most useful when used with partial

budgeting, capital budgeting techniques.

- The major benefits

to use break even analysis is that it indicates the lowest

amount of business activity necessary to prevent losses.

Break even analysis is best

suited to the analysis of one product at a time. It may be

difficult to classify a cost as all variable or all fixed; and

there may be a tendency to continue to use a break even analysis

after the cost and income functions have changed.

Voltar Company

manufactures and sells a telephone answering

machine. The company's contribution format income

statement for the most recent year is given below:

| |

Total |

Per unit |

Percent of

sales |

|

Sales |

$1,200,000 |

$60 |

100% |

|

Less variable

expenses |

900,000 |

45 |

?% |

| |

|

|

|

|

Contribution

margin |

300,000 |

15 |

?% |

|

Less fixed

expenses |

240,000 |

|

|

| |

|

|

|

|

Net operating

income |

$60,000 |

|

|

| |

|

|

|

Required:

Calculate break-even point both in units and sales

dollars. Use the equation method.

Solution:

Sales = Variable expenses + Fixed expenses +Profit

$60Q

= $45Q + $240,000 + $0

$15Q

= $240,000

Q =

$240,000 / 15 per unit

Q =

16,000 units; or at $60 per unit, $960,000

Alternative

solution:

X =

0.75X + 240,000 + $0

0.25X = $240,000

X =

$240,000 / 0.25

X =

$960,000; or at $60 per unit, 16,000 units

Relevant Articles:

|