|

Learning Objectives of this

article:

-

Define and explain capital rationing decision

process?

Definition and Explanation:

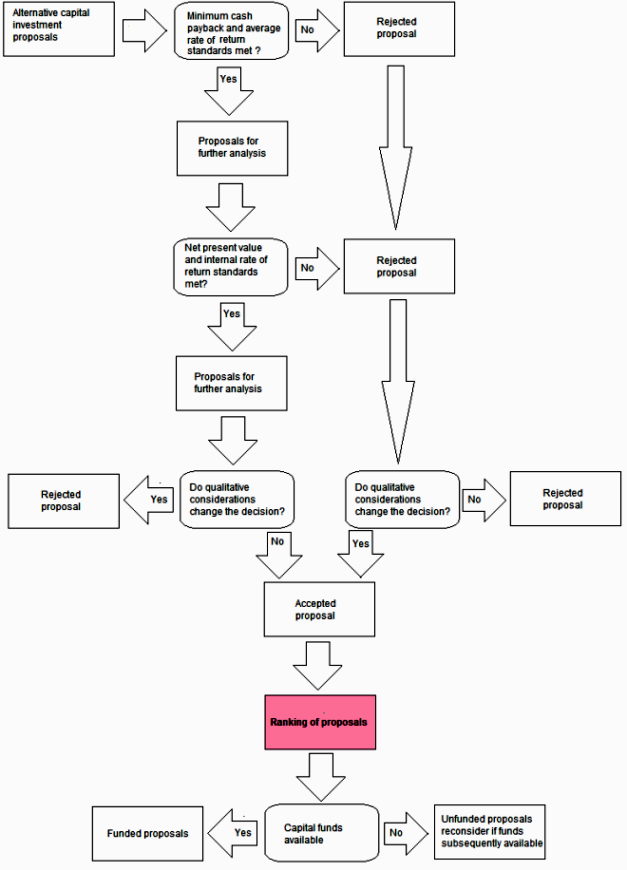

Capital rationing is the process by

which management allocates available investment

funds among competing capital investment proposals.

Normally, management uses various combinations of

the valuation methods in developing an effective

approach to capital rationing.

In capital rationing, an initial screening of

alternative proposals is usually performed by

establishing minimum standards for the cash payback

and the average rate of return methods. The

proposals that survive this initial screening are

further analyzed using the net present value and

internal rate of return methods. Throughout the

capital rationing process, qualitative factors

related to each proposal should also be considered.

For example the acquisition of new, more efficient

equipment that eliminates several jobs could lower

employee morale to a level that could decrease over

all plant productivity. alternatively, new equipment

might improve the quality of the product and thus

increase consumer satisfaction and sales. The

final step in the capital rationing process is to

rank the proposals according to management's

criteria, compare the proposals with the funds

available, and select the proposals to be funded.

The unfunded proposals may be considered if funds

later become available. The following flowchart

portrays the capital rationing decision process:

Capital Rationing Decision Process

|