Definition and Explanation:

Normally, two methods are used to prepare statement

of cash flows. One is the direct method and other is the

indirect method. On this page we are going to

explain direct method. This method is also known as

income statement method. This method reports cash

receipts and cash disbursements from operating

activities. The difference between theses two

amounts is the net cash flow from operating

activities. In other words, the direct method

deducts from operating cash receipts the operating

cash disbursements. This method results in the

presentation of condensed cash receipts and cash

disbursements statement.

The

direct and indirect methods are different only to

the extent of calculation of cash flows from

operating activities. The cash flow from investing

activities and financing activities are calculated

in the same way under both the methods.

Example:

To

illustrate direct method of statement of cash flows, we

will use the first year of operation for Tax

Consultants Inc. The company started on 1st January

2003, When it issued 60,000 shares of $1 par value

common stock for $60,000 cash. The company rented

its office space and furniture and equipment, and it

performed tax consulting services throughout the

first year. The comparative balance sheets at the

beginning and end of the year 2003 appear as

follows:

|

Tax

Consultants Inc.

Comparative Balance Sheets

|

Assets |

Dec. 31, 2003 |

Jan. 1, 2003 |

Change (Increase/Decrease) |

|

Cash |

$49,000 |

$-0- |

$49,000 Increase |

|

Accounts receivable |

36,000 |

-0- |

36,000 Increase |

| |

|

|

|

|

Total |

$85,000 |

-0- |

|

| |

|

|

|

|

Liabilities and Stockholders'

Equity |

|

|

|

|

Accounts payable |

$5,000 |

$-0- |

$5,000 Increase |

|

Common stock ($1 par) |

60,000 |

-0- |

60,000 Increase |

|

Retained earnings |

20,000 |

-0- |

20,000 Increase |

| |

|

|

|

|

Total |

$85,000 |

$-0- |

|

| |

|

|

|

|

The income

statement and additional information for tax consultants Inc.

are as follows:

|

Tax

Consultants Inc.

Income Statement

For the year ended Dec. 31, 2003

|

Revenues |

$125000 |

|

Operating expenses |

85000 |

| |

|

|

Income before income taxes |

40,000 |

|

Income tax expenses |

6,000 |

| |

|

|

Net income |

$34,000 |

| |

|

Additional Information:

Examination of selected data

indicates that a dividend of $14,000 was

paid during the year.

|

Read the following 3 steps for

the preparation of statement of cash flows of Tax consultant Inc.

carefully:

Step 1: Determine the Change in

Cash:

To prepare a statement of cash

flows, the first step is to determine the

change in cash. This is a simple step. Tax

Consultants Inc. had no cash on hand at the

beginning of the year 2003, but $49000 was on hand

at the end of the year 2003. Thus the change in cash

for 2003 was an increase of $49,000.

Step2: Determine

Net Cash Flow From Operating Activities:

Under generally

accepted accounting principles, most companies use

the accrual basis of accounting, requiring that

revenue be reported when earned and that expenses be

recorded when incurred. Net income may include

credit sales that have not been collected in cash

and expenses incurred that may not have been paid in

cash. Thus, under accrual basis of accounting, net

income will not indicate the net cash flow from

operating activities.

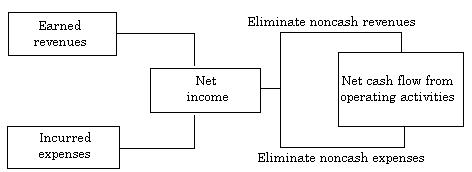

To arrive at net

cash flow from operating activities, it is necessary

to report revenues and expenses on a cash basis.

This is done by eliminating the effects of income

statement transactions that did not result in a

corresponding increase or decrease in cash. The

relationship between net income and net cash flow

from operating activities is graphically depicted as

follow:

Net

income versus Net cash Flow From Operating

Activities

The conversion of

net income to net cash flow from operating

activities may be done through either a direct or

indirect method. But on this page we will discuss

only direct method.

As indicated from

the accrual basis income statement, Tax Consultants

Inc. reported revenues of $ 125,000. However,

because the company's accounts receivable increased

during 2003 by $36,000, only 89,000 ($125000 -

$36,000) in cash was collected on these revenues.

Similarly, Tax Consultants Inc. reported operating

expenses of $85,000, but accounts payable increased

during the period by $5,000. Assuming that these

payables related to operating expenses, cash

operating expenses were $80,000 ($85,000 - $5,000).

Because no taxes payable exist at the end of the

year, the $6,000 income tax expenses for 2003 must

have been paid in cash during the year. Then the

computation of net cash flow from operating

activities is as follows:

|

Cash collected from revenues |

$89,000 |

|

Cash payment for expenses |

80,000 |

| |

|

|

Income before income taxes |

9,000 |

|

Cash payments for income taxes |

6,000 |

| |

|

|

Net cash provided by operating

activities |

$3,000 |

| |

|

| |

|

|

"Net cash provided by operating

activities" is the equivalent of

cash-basis net income. |

|

"Net cash used by

operating activities" is equivalent to

cash-basis net loss |

|

Step 3: Determine Net Cash Flows from Investing

and Financing Activities:

Once the net cash

from operating activities is computed, the next step

is to determine whether any other changes in balance

sheet accounts caused an increase or decrease in

cash.

For example, an

examination of the remaining balance sheet accounts

for Tax Consultation Inc. shows that both common

stock and retained earnings have increased. The

common stock increase of $60,000 resulted from the

issuance of common stock for cash. The issuance of

common stock is a receipt of cash from a financing

activity and is reported as such in the statement of

cash flows. The retained earnings increase of

$20,000 is caused by two items:

- Net income of

$34000 increased earnings.

- Dividends

declared of $14,000 decreased retained earnings.

Net income has been

converted into net cash flow from operating

activities, as explained earlier. The additional

data indicate that the dividend was paid. Thus, the

dividend payment on common stock is reported as a

cash outflow, classified as a financing activity.

The statement of cash flows of Tax Consultants Inc. is as follows:

Tax Consultants INC.

Statement of Cash Flows

For the year ended December 31, 2003

| Cash Flows from

Operating Activities |

|

|

| Cash collected

from revenues |

|

$89,000 |

| Cash payment for

expenses |

|

80,000 |

| |

|

|

|

Income before income taxes |

|

40,000 |

|

Income tax expenses |

|

6,000 |

| |

|

|

| Net cash provided

by operating activities |

|

$3,000 |

| Cash Flows from

Investing Activities |

|

|

| Issuance of common stock |

60,000 |

|

| Payment of cash

dividends |

(14,000) |

|

| |

|

|

| Net cash provided

by financing activities |

|

46,000 |

| |

|

|

| Net increase in

cash |

|

49,000 |

| Cash, January 1

2003 |

|

-0- |

| |

|

|

| Cash, December 31,

2003 |

|

$49,000 |

| |

|

|

|

As indicated,

the $60,000 increase in common stock results in a cash

inflow from a financing activity. The payment of $14,000 in

cash dividends is classified as a use of cash from a

financing activity. The $49000 increase in cash reported in

the statement of cash flows agrees with the increase of

$49,000 shown as the change in the cash account in the

comparative balance sheet. There were no investing activity

effecting cash during the year.

Advantages of Direct Method:

The principle

advantage of direct method is that it shows

operating cash receipts and payments. That is, it is more

consistent with objective of a statement of cash flows - to

provide information about cash receipts and cash payments -

than the

indirect method,

which does not report operating cash receipts and payments.

Supporters of the direct method contend that knowledge of

the specific source of operating cash receipts and the

purpose for which operating cash payments were made in past

periods is useful in estimating future operating cash flows.

Furthermore, information about amounts of major classes of

operating cash receipts and payments is more useful than

information only about their arithmetic sum (the net cash

flow from operating activities). Such information is more

revealing of an enterprise's ability to:

-

generate

sufficient cash from operating activities to pay its

debts.

-

reinvest

in its operations.

-

to make

distributions to its owners.

Many companies

indicate that they do not currently collect information in a

manner that allows them to determine amounts such as cash

received from customers or cash paid to suppliers directly

from their accounting system. But supporters of the direct

method contend that the incremental cost of assimilating

such cash receipts and payments data is not significant.

|