LIFO Liquidation:

(An Issue Related to LIFO

Inventory Valuation Method):

Learning objectives of this article:

-

Define and explain the term "LIFO Liquidation".

Definition of LIFO Liquidation:

The

erosion of the LIFO inventory is referred to as

LIFO liquidation. Erosion means the

unavailability or shortage of raw materials or other

inputs that enforces companies to use its existing

assets. LIFO liquidation leads to distortion of net

income and substantial tax payments.

Example:

To

understand the LIFO liquidation problem assume that

XYZ company has 30,000 ponds of steel in its

inventory on December 31, 2004. Costed on a

traditional LIFO approach.

|

Ending Inventory 2004 |

|

|

Ponds |

Unit

Cost |

LIFO Cost |

|

2001 |

8,000 |

$4 |

$32,000 |

|

2002 |

10,000 |

6 |

60,000 |

|

2003 |

7,000 |

9 |

63,000 |

|

2004 |

5,000 |

10 |

50,000 |

|

|

|

|

|

|

|

30,000 |

|

$205,000 |

|

|

|

|

|

|

The

ending 2004 inventory comprises costs from past

periods. These costs are called layers (increase

from period to period). The first layer is

identified as the base layer. The layers for XYZ are

shown below:

2004

Layer |

$50,000

(5,000 × 10) |

2003

Layer |

$63,000

(7,000 × 9) |

2002

Layer |

$60,000

(10,000 × 6) |

2001

Base Layer |

$32,000

(8,000 × 4) |

|

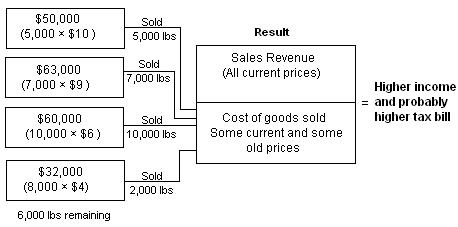

The

price of steel has increased over the 4 year period.

In 2005, the company experienced a metal shortages

and had to liquidate much of its inventory (a LIFO

liquidation). At the end of 2005, only 6,000 ponds

of steel remained in inventory. Because the company

is using LIFO, the most recent layer, 2004, is

liquidated first, followed by the 2003 layer and so

on.

As a

result the costs from preceding periods are matched

against sales revenues reported in current dollars.

This leads to a distortion in net income and a

substantial tax bill in the current period. These

effects are shown below:

To

alleviate the LIFO liquidation problems and to

simplify the accounting, goods can be combined into

pools. A pool is defined as a group of items of a

similar nature. Thus, instead of only identical

units, a number of similar units or products are

combined and accounted for together. This method is

referred to as the specific goods pooled LIFO

approach. With the specific goods pooled LIFO

approach, LIFO liquidations are less likely to

happen because the reduction of one quantity in the

pool may be offset by an increase in another.

The

specific goods pooled LIFO approach eliminates some

of the disadvantages of the specific goods

(traditional) accounting for LIFO inventories. This

pooled approach, using quantities as its measurement

basis, however, creates other problems.

First

most companies are continually changing the mix of

their products, materials, and production methods. A

business once engaged in manufacturing train

locomotives may now be involved in the automobiler

or aircraft business. A business that had used

cotton fabric in its clothing now uses synthetic

fabric (dacron, nylon, etc.). If a pooled approach

using quantities is employed, such changes mean that

the pools must be continually redefined. This can be

time consuming and costly.

Second, even when such

an approach is practical, an erosion (LIFO

liquidation) of the layers often results, and much

of the LIFO costing benefit is lost. An erosion of

the layers results because specific good or material

in the pool may be replaced by another good or

material either temporarily or permanently. This

replacement may occur for competitive reasons or

simply because a shortage of a certain material

exists. Whatever the reason, the new item may not be

similar enough to be treated as part of the old

pool. Therefore any inflationary profit deferred on

the old goods may have to be recognized as the old

goods are replaced.

Relevant Articles:

|