Learning objectives of this article:

- What is difference between normal

and abnormal loss?

- What is accounting treatment for

normal and abnormal losses in

consignment sales?

Normal and Abnormal Losses:

Sometime a part of the goods sent on

consignment is damaged or lost. Damages or

losses normal in transporting and handling

goods. A loss may be a normal loss or

abnormal loss.

Normal Loss:

Loss of quantity of goods in the normal

course of business and inherent and thus

inevitable or unavoidable, such as loss

because of loading and unloading of goods,

leakage, evaporation or shrinkage is known

as normal loss.

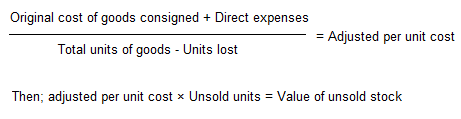

The treatment of normal loss is to charge

it to consignment account. The total cost of

goods sent is charged to the units

remaining. Value of stock is inflated to

cover the normal loss. In other words such

loss is absorbed by the remaining units.

Example:

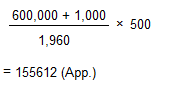

2000 radio sets are consigned @ $300 per

radio set. Freight being $1000. Due to a

normal loss only 1960 radio sets are

received by the consignee. If 500 radio sets

are in stock (i.e unsold sets), the value of

closing stock would be calculates as

follows:

No separate entry is made in the books of

consignor in case of normal. such loss is

considered while calculating the cost of

stock left unsold with the consignee. The

value of unsold stock on consignment is

increased because the value of stock is the

proportion of the cost of the goods

consigned and direct expenses that the

quantity of stock bears to the total

quantity of goods consigned as diminished by

the normal loss of goods. In brief,

valuation of stock will be made:

Abnormal Loss:

This type of loss is an avoidable loss

because it does not arise due to the nature

of the goods. Such loss may arise due to

hard luck of consignor (i.e. destruction of

goods by fire, an accident or theft). Such

losses are more or less abnormal and, in any

case, do not occur frequently. This type of

loss does not effect the value of goods and

if part of the consignment has been lost in

such a manner, one should debit the value of

the goods lost to abnormal loss

account/profit and loss account. and credit

the consignment account so that one may

judge the profitability of the consignment

properly. In case, if this loss is ignored

like normal loss, the the profit shown by

the consignment account will be lower than

what it would have been, had the loss not

occurred. So, we let the consignment account

show the same result as the loss had not

been taken place. On the preparation of the

final accounts of the business (trading and

profit and loss account), this loss is

finally shown on the debit side of the

profit and loss account being a loss of the

business as a whole.

Example:

On 1st January 2010, Z & Co. of New

York

consigned 100 cases of dry milk to T & Co.

of Chicago. The goods were charged at a

Performa invoice value of $10,000 including

a profit of 25% on cost. On the

same date the consignor paid $600 for

freight and insurance. On 1st July, the

consignee paid clearing charges $1,000,

carriage $200. On 1st August consignee sold

80 cases for $10,500 and sent a remittance

for the balance due to the consignor after

deducting commission at the rate of 5% on

gross sale proceeds. Required: prepare

consignment account and T & Co. account in

the books of Z & Co.

Solution:

Consignment Account

|

Date |

Particulars |

Amount |

Date |

Particulars |

Amount |

|

2010 |

|

|

2010 |

|

|

|

Jan.1 |

Goods sent on consignment A/C |

10,000 |

Jan.1 |

Goods sent on consignment A/C |

2,500 |

| |

Bank A/C (freight and insurance) |

600 |

Aug.1 |

T & Co. (sales) |

10,500 |

|

July.1 |

T & Co. |

|

|

Stock on consignment |

2,360 |

| |

Clearing charges 1000 |

|

|

|

|

| |

Carriage

200 |

|

|

|

|

| |

Commission

525

|

1,725 |

|

|

|

| |

|

|

|

|

|

| |

Stock reserve A/C |

500 |

|

|

|

| |

Profit trf. to General P&L A/C |

2,535 |

|

|

|

| |

|

|

|

|

|

| |

|

15,360 |

|

|

15,360 |

| |

|

|

|

|

|

| |

|

|

|

|

|

T & Co. Account

|

Date |

Particulars |

Amount |

Date |

Particulars |

Amount |

|

2010 |

|

|

2010 |

|

|

| Aug.1 |

Consignment to Chicago A/C - sales |

10,500 |

July.1 |

Consignment to Chicago A/C - exp. &

commission |

1,725 |

| |

|

|

Aug.1 |

Bank A/C - final payment |

|

| |

|

|

|

|

8,775 |

| |

|

|

|

|

|

| |

|

10,500 |

|

|

10,500 |

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

Working Notes:

| (i) |

Loading on goods sent on

consignment 25% on $10,000. |

2,500 |

| (ii) |

Loading on closing stock 25% on

$2,000. |

500 |

| (iii) |

Direct expenses included in

valuation of closing stock 1/5 of

$1,800 |

360 |

|