|

Learning Objectives:

-

Define and explain the

depreciation fund method or sinking fund method

of depreciation.

-

Prepare journal entries to record

depreciation under this method.

Contents:

Under depreciation fund method or sinking fund method, a fund is created

with the amount of annual depreciation. An amount

equal to annual depreciation is invested each year

in government papers or in some other gilt-edged

securities outside the business. The income earned

from investment is deposited into the fund and

immediately reinvested. This process is carried out

throughout the life of the asset and at the end of

its life a sum equal to the cost of the asset is

accumulated in the fund. Then the whole investment

is sold and a new asset is acquired with the sale

proceeds.

The special feature of this method is that the sum

required to buy the new asset is available from

depreciation or sinking fund. As a result, the

working capital of business is preserved. Sinking

fund method is specially applicable to costly

machines in large scale industries.

The entries to be made will be as follows:

At the end of the first year:

-

Debit profit and loss account

and credit depreciation fund account with amount

of annual depreciation.

-

Debit depreciation fund

investment account and credit bank account with

an equal amount.

At the end of each subsequent year:

-

Debit bank account and credit

depreciation fund account with amount of

interest earned on investment.

-

Debit profit and loss account

and credit depreciation fund account with amount

of annual depreciation.

-

Debit depreciation fund

investment account and credit bank account with

amount of annual depreciation plus interest

received.

In the last year:

-

Debit bank account and credit

depreciation fund account with amount of

interest earned on investment.

-

Debit profit and loss account

and credit depreciation fund account with amount

of annual installment.

-

Debit bank account and credit

depreciation fund investment account with

proceeds of sale of investment. Any profit or

loss on sale of investment should be transferred

to depreciation fund account.

-

Debit the account of new asset

and credit the bank account with cost of

replacement.

-

Debit depreciation fund account

and credit the account of old asset which has

now become useless.

Note: In the last year this

amount should not be invested in the purchase of

investments.

In the balance sheet that is

prepared during the period of building up the

depreciation fund, depreciation fund account shall

be shown on the liabilities side and depreciation

and depreciation fund investment account on the

asset side, whereas the asset for which this

depreciation fund is being created will appear at

its original cost.

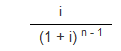

The amount of annual depreciation to

be provided for the depreciation will be ascertained

from sinking fund table, an extract from which is

given below:

Sinking Fund Table

Periodic deposit which will amount

$1

|

Period |

3% |

4% |

5% |

6% |

|

1 |

1.000000 |

1.000000 |

1.000000 |

1.000000 |

|

2 |

.492611 |

.490196 |

.487805 |

.485437 |

|

3 |

.323530 |

.320348 |

.317209 |

.314110 |

|

4 |

.239027 |

.235490 |

.232012 |

.228591 |

|

5 |

.188355 |

.184627 |

.180975 |

.117396 |

| |

|

|

|

|

|

6 |

.154597 |

.150762 |

.147017 |

.143363 |

|

7 |

.130506 |

.126610 |

.122820 |

.119135 |

|

8 |

.112456 |

.108528 |

.104772 |

.101036 |

|

9 |

.098434 |

.094493 |

.090690 |

.087022 |

|

10 |

.087231 |

.083291 |

.079505 |

.075868 |

| |

|

|

|

|

|

15 |

.053767 |

.049941 |

.046342 |

.042963 |

|

20 |

.037216 |

.033582 |

.030243 |

.027185 |

|

25 |

.027428 |

.024012 |

.020952 |

.018277 |

|

30 |

.021019 |

.017830 |

.015051 |

.012649 |

|

35 |

.016539 |

.013577 |

.011072 |

.008974 |

|

40 |

.013262 |

.010523 |

.008278 |

.006442 |

|

45 |

.010785 |

.008262 |

.006262 |

.004701 |

|

50 |

.008866 |

.006550 |

.004777 |

.003444 |

|

C acquires a 5 years' lease for

$40,000. It is decided to provide for the

renewal of lease immediately after 5 years by

setting up a depreciation fund. It is expected

that investment will fetch interest at 5% p.a.

Sinking fund table shows that $0.180975 invested

each year will produce $1 at the end of 5 years

at 5% p.a.

At the expiry of the lease, the

depreciation fund investments are sold for

$31,205 and immediately thereafter the lease is

renewed for a further period of 5 years by a

payment of $44,000.

Required: Make journal

entries.

Solution:

|

Annual depreciation =

40,000 ×

.180975 |

|

Journal Entries |

|

1st Year |

|

|

|

|

|

Jan. 1 |

Lease

Account |

Dr. |

40,000 |

|

| |

Bank Account |

|

|

40,000 |

| |

(Being lease

purchased for 5 years) |

|

|

|

| |

|

|

|

|

|

Dec. 31 |

Profit and

loss Account |

Dr. |

7,239 |

|

| |

Depreciation fund Account |

|

|

7,239 |

| |

(Being

annual depreciation charged) |

|

|

|

| |

|

|

|

|

|

Dec. 31 |

Depreciation

fund investment Account |

Dr. |

7,239 |

|

| |

Bank Account |

|

|

7,239 |

| |

(Being

amount of depreciation fund

invested) |

|

|

|

| |

|

|

|

|

|

2nd Year |

|

|

|

|

|

Dec. 31 |

Bank Account |

Dr. |

362 |

|

| |

Depreciation fund Account |

|

|

362 |

| |

(Being

interest received on

depreciation fund

investments) |

|

|

|

| |

|

|

|

|

|

Dec. 31 |

Profit and

loss Account |

Dr. |

7,239 |

|

| |

Depreciation fund Account |

|

|

7,239 |

| |

(Being

annual depreciation charged) |

|

|

|

| |

|

|

|

|

|

Dec. 31 |

Depreciation

fund investment Account |

Dr. |

7,601 |

|

| |

Bank Account |

|

|

7,601 |

| |

(Being

investment purchased) |

|

|

|

| |

|

|

|

|

|

3rd Year |

|

|

|

|

|

Dec. 31 |

Bank Account |

Dr. |

742 |

|

| |

Depreciation fund Account |

|

|

742 |

| |

(Being

interest received on

depreciation fund

investments) |

|

|

|

| |

|

|

|

|

|

Dec. 31 |

Profit and

loss Account |

Dr. |

7,239 |

|

| |

Depreciation fund Account |

|

|

7,239 |

| |

(Being

annual depreciation charged) |

|

|

|

| |

|

|

|

|

|

Dec. 31 |

Depreciation

fund investment Account |

Dr. |

7,981 |

|

| |

Bank Account |

|

|

7,981 |

| |

(Being

investment purchased) |

|

|

|

| |

|

|

|

|

|

4th Year |

|

|

|

|

|

Dec. 31 |

Bank Account |

Dr. |

1,141 |

|

| |

Depreciation fund Account |

|

|

1,141 |

| |

(Being

interest received on

depreciation fund

investments) |

|

|

|

| |

|

|

|

|

|

Dec. 31 |

Profit and

loss Account |

Dr. |

7,239 |

|

| |

Depreciation fund Account |

|

|

7,239 |

| |

(Being

annual depreciation charged) |

|

|

|

| |

|

|

|

|

|

Dec. 31 |

Depreciation

fund investment Account |

Dr. |

8,380 |

|

| |

Bank Account |

|

|

8,380 |

| |

(Being

investment purchased) |

|

|

|

| |

|

|

|

|

|

5th Year |

|

|

|

|

|

Dec. 31 |

Bank Account |

Dr. |

1,560 |

|

| |

Depreciation fund Account |

|

|

1,560 |

| |

(Being

interest received on

depreciation fund

investments) |

|

|

|

| |

|

|

|

|

|

Dec. 31 |

Profit and

loss Account |

Dr. |

7,239 |

|

| |

Depreciation fund Account |

|

|

7,239 |

| |

(Being

annual depreciation charged) |

|

|

|

| |

|

|

|

|

|

Dec. 31 |

Bank Account |

Dr. |

31,205 |

|

| |

Depreciation fund investment

Account |

|

|

31,205 |

| |

(Being

depreciation fund

investments sold) |

|

|

|

| |

|

|

|

|

|

Dec. 31 |

Depreciation

fund investment Account |

Dr. |

4 |

|

| |

Depreciation fund Account |

|

|

4 |

| |

(Being the

profit on the sale of

investment transferred to

depreciation fund account) |

|

|

|

| |

|

|

|

|

|

Dec. 31 |

Depreciation

fund Account |

Dr. |

40,004 |

|

| |

Lease Account |

|

|

40,004 |

| |

Profit and loss Account |

|

|

|

| |

(Depreciation fund account

transferred to lease

account) |

|

|

|

| |

|

|

|

|

|

Dec. 31 |

Lease

Account |

Dr. |

44,000 |

|

| |

Bank Account |

|

|

44,000 |

| |

(Being new

lease purchased for 5 years) |

|

|

|

| |

|

|

|

|

|

There is very close relationship

between annuity method and depreciation fund

method. Under both the method:

-

Compound interest is taken

into account.

-

Provision is made for the

replacement of asset.

-

There are equal annual

charges to revenue.

Depreciation fund method assumes

a constant rate of return on investments in

identical securities. This is hardly true,

because rates of interest do vary every now and

then. Variation of rate upsets the earlier

periodic allocation of depreciation and entails

recitation. Further the amount realized on sale

of security rarely agrees with its acquisition

cost due to market fluctuations. This method

cannot be used where any additions are made to

an asset during the year.

|