|

Numerous transactions take place in business

concerns every day. For example, goods are sold to

various customers every day, purchases are made from

suppliers, cash is paid to creditors and is received

from debtors, expenses are paid etc. All these

transactions should be properly analyzed and

recorded. Again, the concept of double change in a

business transaction is important to keep in mind.

To record these changes different accounts are

maintained in the ledger (Read

our detailed article about ledger).

Definition and Explanation of

Account:

Account is the individual record of an asset, a

liability, a revenue, an expense or capital, in a

summarized manner. For example, the individual

record of sales is 'sales account'. In the same way

there are so many accounts which are opened in the

ledger like salary account, machinery account,

furniture account etc. How many accounts there

should be in the ledger of a business? It depends

upon the nature and size of the business.

Generally one full page is fixed in the

ledger for

each account. But it depends, how many times the

changes take place in that particular account. Some

accounts are very busy accounts like cash account,

bank account and sales account. Obviously for such

accounts one page for each will not be enough and

so, they need more pages in the ledger to be fixed.

In some accounts, changes take place only once or

twice in a year, so only one page will be enough.

e.g. machinery account, capital account, loan

account etc.

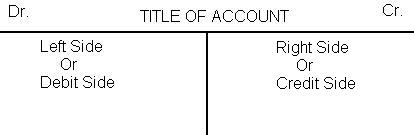

There

are two types of changes that may take place in an

account, e.g. either there will be increase or there

will be decrease. Take the example of cash (an

asset), either there is inflow of cash or there is

outflow of cash. To record these two types of

changes, every account (a page) is divided in two

sides. Increase is recorded on one side and decrease

is recorded on the other side. The specimen of an

account (a 'T' form of an account) is shown

below:

When a change takes place in an

account, either it will be recorded on the left side

(debit side) or on the right side (credit side).

Amounts recorded on the left side of an account,

regardless of the account title, are called debits,

and the account is said to be debited. Amounts

recorded on the right side of an

account are called credits, and the account is

said to be credited. Now keeping in mind the

concept of double change in every business

transactions, we can say that every business

transaction affects a minimum of two accounts and

every change (in a particular transaction) is

recorded in a separate account. Now question arises,

how the changes are recorded in different accounts?

It depends upon the rules of debiting and crediting

which have been discussed on

rules for debits and credits page.

Example:

For example,

furniture is purchased for $20,000 on cash basis.

This is a business transaction and it has brought

two changes.

- Increase in

furniture by $20,000 (an asset).

- Decrease in

cash by $20,000 (an asset).

These two changes

are recorded in two accounts: furniture account and cash account in the following way:

Furniture Account

Cash Account

When an amount

of $20,000 is recorded on the debit side

(left side) of

furniture account, it is said that furniture

account is debited and when an amount of

$20,000 is recorded on the credit side

(right side) of

cash account, it is said that cash account

is credited. When an asset increases the

account of that asset is debited and when an

asset decreases the account of that asset is

credited.

Click here to read a detailed article about

rules of debit and credit.

|