Subdivision of Journal:

Definition of Subdivision:

In a

large business concern a journal is divided into

parts so that several clerk could work at the same

time. This is known as subdivision of journal.

Purpose of Subdivision:

In

small concerns only one journal and one ledger may

serve the purpose, because the number of

transactions is very small. But in large business

concerns the number of transactions are numerous,

just one journal and one ledger will not do the job.

That will cause much inconvenience i.e., if we have

only one journal in a large scale business, it is

not possible for one bookkeeper to record all the

transactions in time. On the other hand, it will not

be possible for more than one person to use the same

journal simultaneously with the result that the

accounting work will fall in arrear.

There

are some more factors which necessitate the use of

more than one subsidiary book (journal):

-

If

all the transactions are recorded in one book

(journal), the book will be very large, bulky,

and difficult to handle.

-

If one

bookkeeper is asked to record all the transactions,

the possibility of errors and mistakes will be

great. It will also create opportunities for

committing fraud.

-

If all

the transactions are recorded in one book, it will

be difficult to trace out a particular transaction

in future.

How Many Journals A Business Should

Have?

We know

that different types of transactions take place in a

business concern. Some transactions take place

repeatedly (hundreds to thousands times in a year) and

some transactions take place once or twice in a year.

Obviously, it is not logical to provide a separate

journal for transactions which rarely take place.

For this

purpose different groups of transactions are made and a

separate book is provided for each group. Each group is

consisted of similar types of transactions. Journal is

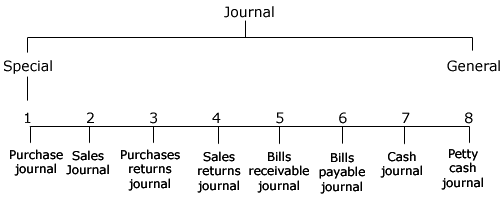

mainly divided into two:

-

Special journal

-

General

journal

Special Journal:

By special

journal we mean, a journal in which transactions relating to

a certain special group or recorded. Special journal is

again subdivided into eight groups:

-

Purchases

book or purchases journal

-

Sales book or

sales journal

-

Purchases returns

book or purchases returns journal

-

Sales returns book

or sales returns journal

-

Bills receivable book

-

Bills payable book

-

Cash book or cash journal

-

Petty cash book

General Journal:

The transactions which do not fall

with in the scope of above mentioned books, are recorded in this journal e.g.

purchase of an asset on credit, depreciation on assets, expenses payable, bad

debts etc. It is also known as journal proper, Modern journal or principle

journal. Some authors call it only "journal".

The main function of the above

books is to supply necessary information to the ledger. All the transactions are

posted in the ledger on the basis of information available from these books, so

these books are called subsidiary books

Advantages of Subdivision of Journal:

The following advantages are

derived from division of journal:

-

Because of subdivision the

books cannot be bulky and hence there will be no difficulty in handling

them.

-

Accounting work is divided amongst

a large number of employees. So work is done nicely and promptly and no work is

left in arrear.

-

Each employee can be held

responsible for mistakes committed by him. This serves as caution and care to

the employees.

-

The efficiency of the

employees increases because of the division of labor.

-

By keeping the book under the

custody of different employees the chances of fraud and defalcation are

minimized.

Relevant Articles:

|